Yearly depreciation formula

Relevance and Uses of Average Formula. To calculate use this formula.

Declining Balance Depreciation Double Entry Bookkeeping

Yearly Depreciation Closing.

. Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value. It creates a more significant depreciation which allows for greater tax deductions and minimizing the taxable income during the assets first years. 1 nth root of Residual ValueCost of the asset 100 where n useful life.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Form the yearly factors by dividing the digits sum into the years remaining. Double-Declining Balance DDB Depreciation Method Definition With Formula The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a.

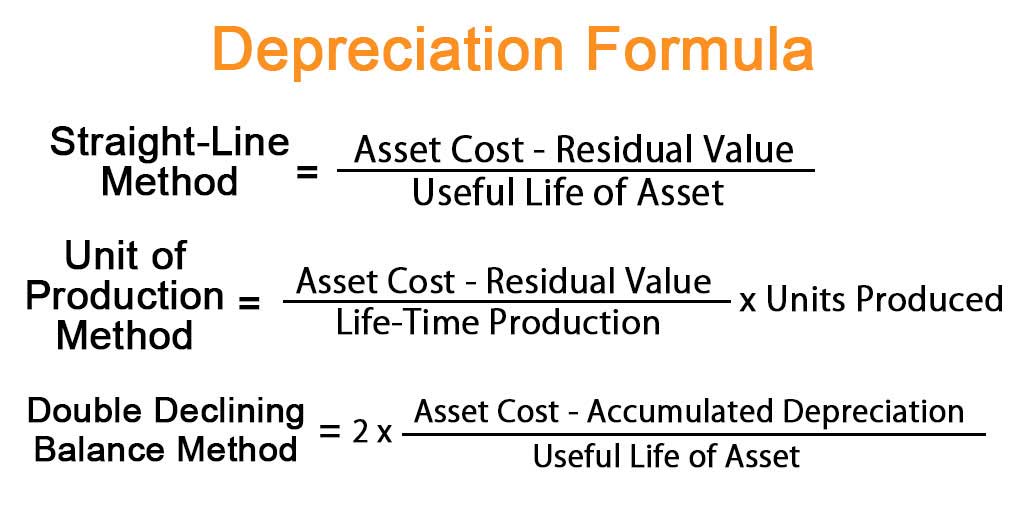

The formula for straight-line depreciation is. D j C-S nn-j1T where T0. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

Annual factor x Depreciable amount. Purchase cost- salvage valueuseful life. For simplicity assume that the only operating expense of the company is depreciation expense no rent expense wage expense etc.

The SOYD depreciation formula is. If you want to assume a higher rate of depreciation you can multiply by two. Divide the balance by the number of years in the useful life.

Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. The formula for calculating depreciation using each of these methods is given below. It also refers to the spreading out.

Straight Line Depreciation Formula The following algorithms are used in our calculator. For example consider a company that generates yearly revenues of 100000. How is it calculated.

The straight-line depreciation formula is. Read more on furniture. The depreciation per period the value of the asset minus the final value which is.

WHO World Health Organisation also uses the average to know the yearly death and birth rate during a particular time. It is a contra-account the difference between the assets purchase price and its carrying value on. The accelerated method makes the asset lose value at a faster rate than the straight-line method.

Final Year Depreciation Expense. The yearly depreciation of that asset is 1600. - For each asset choose between the Straight-Line Sum-of-Years Digits Double Declining Balance or Declining Balance with Switch to Straight-Line.

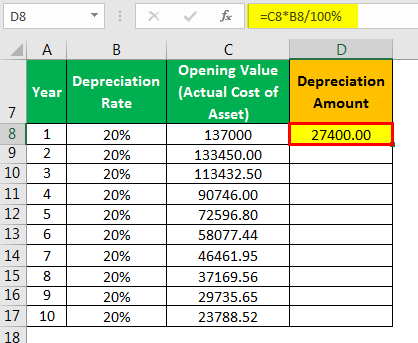

With Free Online Depreciation Calculation Tool you can calculate the total depreciation on a given asset using the Written Down ValueWDV method. The calculation of yearly depreciation under WDVM for 2019 and 2020 is as follows. The following formula calculates depreciation amounts.

Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Calculate yearly depreciation to be booked by Mark Inc on 31122019 and 31122020. If you use this method you must enter a fixed yearly percentage.

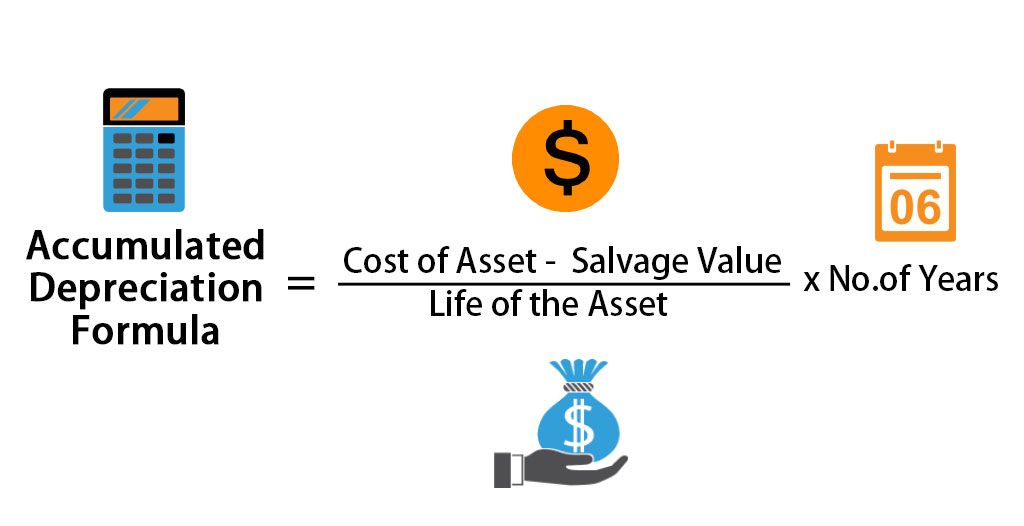

Double declining balance method. To calculate this value on a monthly basis divide the result by 12. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date.

This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets. This gives you the yearly depreciation deduction. Basis 100.

8000 divided by 5 years is 1600. The salvage value is the estimated amount of money the item. The balance is the total depreciation you can take over the useful life of the equipment.

X Number of Depreciation Days x Depr. Depreciation Amount Declining-Bal. 10000 minus 2000 is 8000.

Owns machinery with a gross value of 10 million. Divide the cost of the asset minus its salvage value by the estimated number of years of its useful life. Depreciation cost - salvage value years of useful life.

The following formula determines the rate of depreciation under this method. For instance the Year 1 factor is 1055 the Year-2 factor is 955 etc. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

Depreciation Rate Formula Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

A Complete Guide To Residual Value

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Calculation

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Annual Depreciation Of A New Car Find The Future Value Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Depreciation Rate Formula Examples How To Calculate

Double Declining Balance Method Of Depreciation Accounting Corner